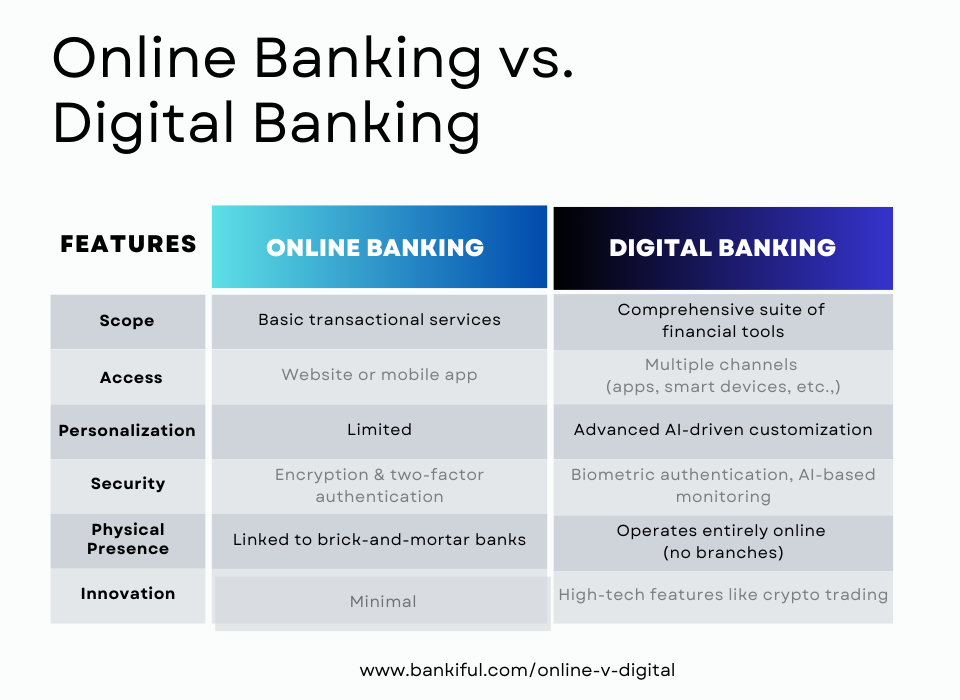

Both digital banking and online banking can be more convenient than traditional in-person banking, but these forms of banking are not the same.

Digital Banking vs Online Banking

Digital banking encompasses a broader spectrum of financial services and products offered entirely through digital channels, often without a physical branch presence. Beyond the basics of online banking, it might include features like:

- Opening new accounts entirely online

- Applying for and managing loans digitally

- Personalized financial management tools and insights

- Mobile-first experiences and app-based functionalities

- Integration with third-party financial apps and services

Online banking primarily refers to performing traditional banking activities via a bank's website that includes:

- Checking balances

- Transferring funds

- Paying bills

- Viewing statements

It's a digital extension of a brick-and-mortar bank.

Differences in Technology & User Experience

Digital Banking Technology:

Digital banking often utilizes the latest technologies to create a more seamless and intuitive user experience on the banking apps that can include:

- Mobile apps designed for on-the-go banking

- Chatbots or virtual assistants for customer support

- Biometric authentication (fingerprint, facial recognition)

- AI-driven personalized recommendations and insights

Online Banking Technology:

Online banking typically employs a more traditional website interface and the user experience might be somewhat standardized across banks and focused on core functionalities.

Differences in Innovation & Services

Digital Banking Innovation:

More likely to introduce innovative financial products and services tailored to a digital-first audience. This could include entirely digital-only banks (also known as neobanks), offering features like early direct deposit or automated savings tools.

Online Banking Innovation:

Tends to focus on providing digital access to existing banking products and services.

Which is Better: Digital Banking or Online Banking

There are good reasons to like both forms of banking. In fact, it's common for people to have an account at a traditional bank that utilizes online banking as well as a digital bank that offers high-yield savings account.

However, when it comes to digital banking the enhanced security features that integrate newer technologies like biometrics and AI-based fraud detection make this form of banking more favorable.

While online banking employs standard security measures like passwords, two-factor authentication, and encryption, the daily onslaught of security breaches calls for enhanced security measures.