Are you familiar with ChexSystems reports? If not, don't worry – you're not alone. ChexSystems is a commonly-used consumer reporting agency that collects and maintains information on consumers' banking behavior.

In this comprehensive guide, we'll delve into everything you need to know about ChexSystems reports and how they can impact your financial health.

What is ChexSystems?

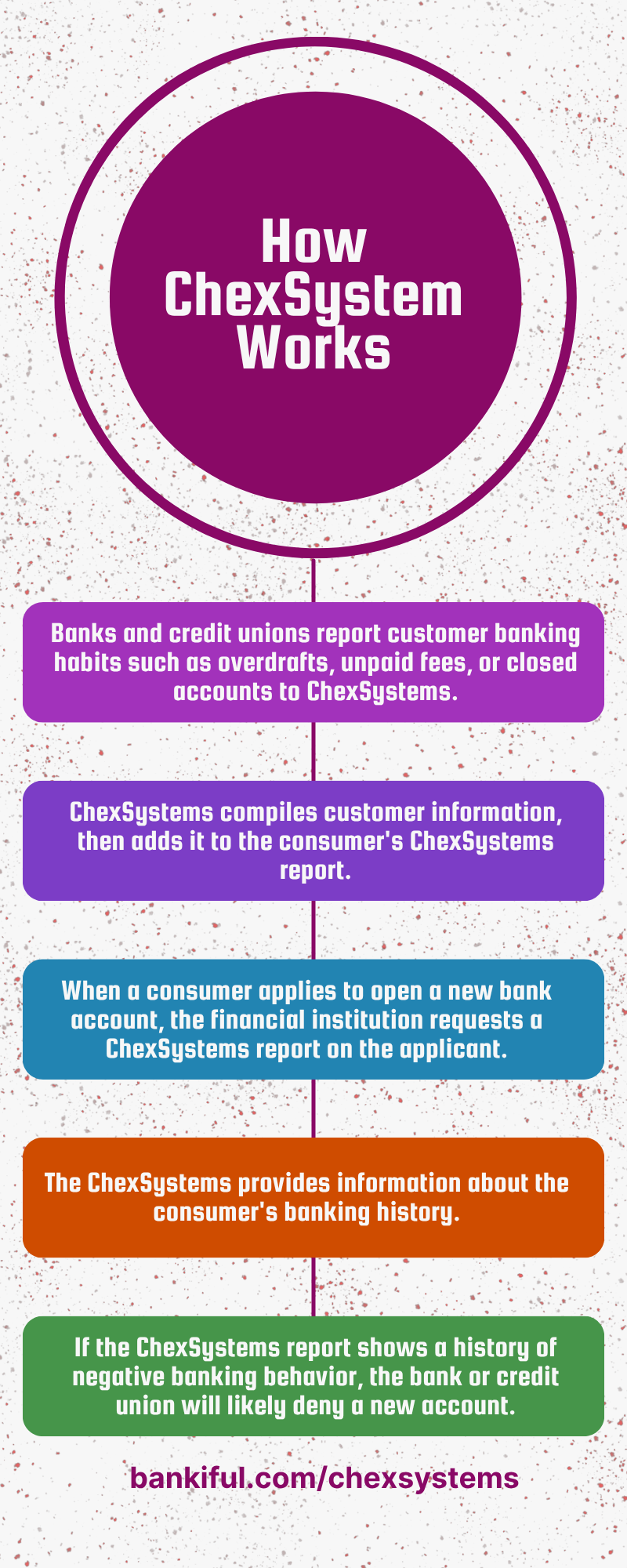

ChexSystems is a consumer reporting agency that collects and maintains information on consumers' banking behavior. It is primarily used by banks and credit unions to assess the risk of opening new accounts for potential customers.

ChexSystems gathers data from financial institutions and compiles the information into individual consumer reports that includes:

- Bounced checks

- Frequent overdrafts

- Unpaid fees or negative balances

- Closed accounts

- Involuntary account closures

- Bounced checks and frequent overdrafts

These reports can have a significant impact on a person's ability to open a new checking or savings account, as banks and credit unions often use the information in ChexSystems reports to determine whether to approve or deny an application.

In essence, ChexSystems acts as a credit reporting agency, but for banking and financial services, rather than for credit cards and loans. ChexSystems also creates a type of score, similar to credit scores.

It's important to note that ChexSystems is not the only consumer reporting agency in the banking industry. There are other similar agencies, such as Early Warning Services and Telecheck, that also collect and report on consumer banking activities. However, ChexSystems is one of the most widely used and influential in the financial services sector.

The biggest problem with ChexSystems

ChexSystems only reports negative banking information. Positive account management or improvements are not included, so even those who recover financially remain at a disadvantage for up to five years.

How ChexSystems work?

Understanding your ChexSystems report

Obtaining a copy of your ChexSystems report is an important step in understanding your financial health and potential banking challenges.

You can see your ChexSystems report online by visiting the ChexSystems website or calling their customer service number.

When reviewing your ChexSystems report, look for any negative items, such as overdrafts, unpaid fees, or closed accounts. Since these items can remain on your report for up to five years, they have a significant impact on your ability to open new bank accounts unless you use a no-ChexSystems bank.

If you find any inaccuracies or errors in your ChexSystems report, you have the right to dispute them. ChexSystems is required by law to investigate your dispute and correct any errors within a 30-day timeframe, similar to credit report disputes. If ChexSystems fails to complete the investigation within 30-45 days, the item must be deleted.

How long do ChexSystems reports stay on your record?

The length of time that negative information can remain on your ChexSystems report is up to seven years, but ChexSystems typically removes items after 5 years.

It's important to note that the five-year timeline starts from the date the negative information was reported to ChexSystems, not from the date the event occurred. This means that even if the original incident happened several years ago, the negative item can still appear on your report for up to five years from the date it was reported.

Tips for improving your ChexSystems report

If you have negative items on your ChexSystems report, there are several steps you can take to improve your standing and increase your chances of opening a new bank account:

- Review your report: Carefully review your ChexSystems report to identify any inaccurate or outdated information. If you find any errors, dispute them with ChexSystems immediately.

- Pay off outstanding debts: If you have any unpaid fees or overdrafts listed on your report, make a concerted effort to pay them off as soon as possible. This will help remove the negative items from your record.

- Open a second chance checking account: Some banks and credit unions offer “second chance” checking accounts specifically for individuals with a history of banking problems. These accounts can help you rebuild your financial reputation and eventually qualify for a standard checking account.

- Be proactive: Stay on top of your ChexSystems report and monitor it regularly for any changes or new information. This will allow you to address any issues quickly and minimize the impact on your ability to open new bank accounts.

- Dispute errors on your ChexSystems Report: If you're unable to open a traditional checking account, review your ChexSystems Report for errors and inaccuracies. Since ChexSystems is a consumer reporting agency, you have the right to dispute accounts to ensure accuracy.

Final takeaway

Your ChexSystems report provides a snapshot of your banking history. Reviewing it empowers you to take control of your financial well-being in addition to helping you stay informed, protect yourself from fraud, and make informed decisions about your banking future.Sinc