Wire transfer scams are increasingly sophisticated, with fraudsters using a combination of psychological manipulation and technological tricks to mimic real banking procedures.

In 2024, U.S. consumers reported more than $12.5 billion in total fraud losses, according to the Federal Trade Commission (FTC)—a 25% jump from the previous year. Of this, bank transfers and wire payments alone accounted for at least $2.09 billion in consumer losses, making them the leading payment method for scam-related losses, ahead of cryptocurrencies and credit cards.

To make matters worse, banks have no obligation to refund customers for funds lost through wire-transfer fraud or scams.

But why do so many bank customers fall for wire-transfer fraud in the first place? Well, here are some reasons:

Social Engineering and Impersonation

Caller ID Spoofing

Scammers manipulate caller ID to display the bank’s official number, making it seem like calls or texts come directly from your bank. The bank will never call you and ask about ACH, direct deposit, wire-transfers or other banking info. These are scams spoofing the bank's caller ID.

Creating Emergency Situations

Scammers invent crises, like a hacked account or pending legal action, that demand immediate wire transfers.

Pressure to Act Quickly

Victims are told they must act fast to resolve the fake issue, discouraging verification or scrutiny.

Professional Language and Scripts

Fraudsters adopt the tone, language, and processes of real bank representatives, often referencing real transactions or using stolen personal information.

Authority Impersonation

Criminals pose as bank officials, company executives (e.g., CEO, CFO), law enforcement, or government agencies to add credibility and urgency.

LifeLock Stolen Funds Reimbursement: Lifelock will cover you for personal expenses incurred as a result of identity theft, including reimbursement for stolen funds, up to $1 Million Coverage, depending on your plan.

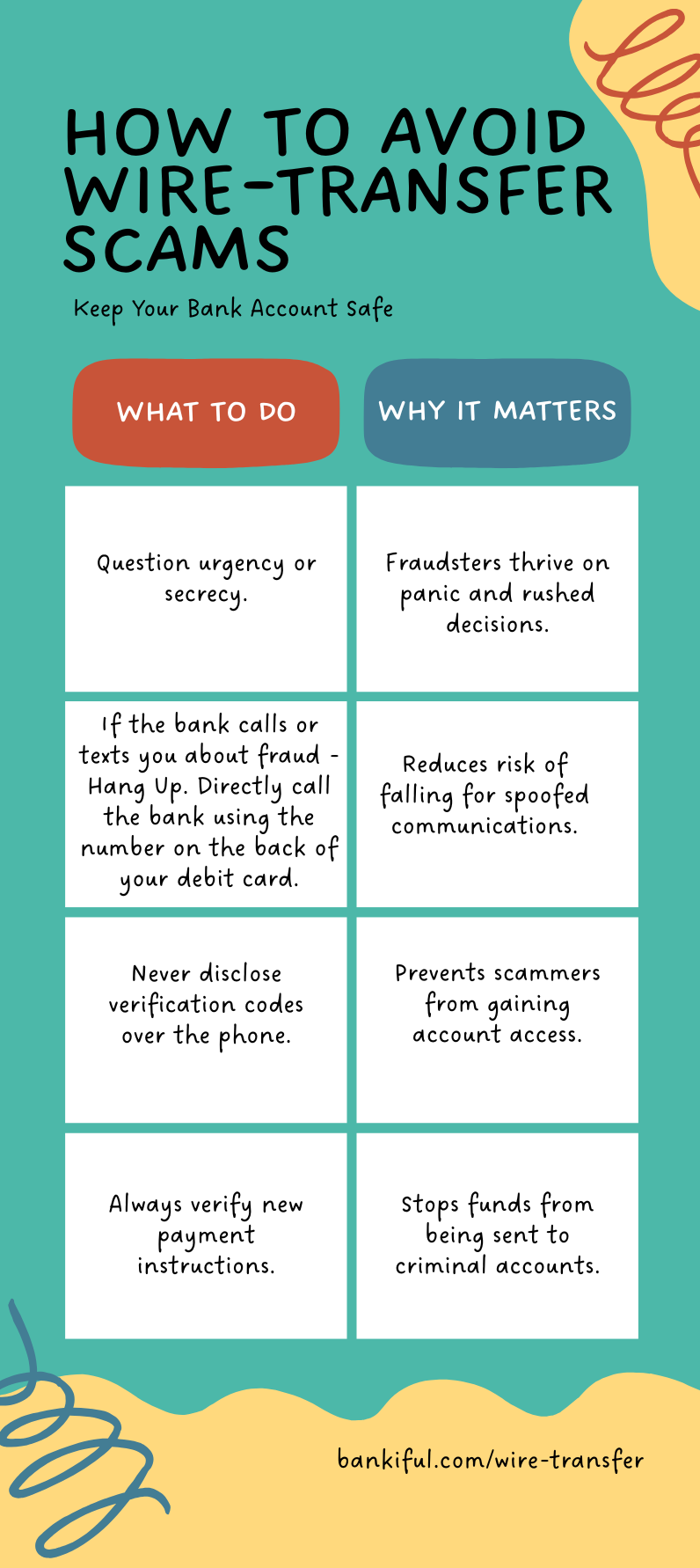

7 Tips To Avoid Wire-Transfer Fraud

Wire-transfer fraud costs victims billions each year; and, in most cases, banks do not reimburse victims of wire fraud.

Financial scammers have perfected the art of deception, blending technology tricks with psychological manipulation to bypass even the most diligent bank customers. Here’s how you can outsmart fraudsters and keep your money safe.

1. Never Share Verification Codes—With Anyone

Your bank’s authentication codes are for your eyes only. Scammers frequently pose as bank staff and insist you read back texts or emails containing codes. No legitimate bank representative will ever ask for this information.

If someone requests a code, hang up and call your bank directly using the number on your card.

2. Question the Caller and Distrust Caller ID

Fraudsters can spoof phone numbers so calls look as if they’re coming from your bank. A friendly, official-sounding voice doesn’t mean it’s real. If you receive an urgent call:

-

End the conversation.

-

Re-dial your bank yourself, preferably from a different phone—never call back a number you were given by the caller.

-

Use only the contact details from your official bank statement or card.

3. Pause Before Acting on Urgent Requests

Pressure is a telltale sign of a scam. Be wary if someone asks you to:

-

Wire money quickly to “protect your account.”

-

“Help” investigate fraud.

-

Keep the conversation secret “for your own security.”

Banks never force you to act instantly. Always take a moment to breathe, think, and verify independently.

4. Review and Double-Check All Wire Instructions

If you’re transferring funds for a real estate purchase, vendor payment, or new business relationship, independently verify payment instructions:

-

Contact known representatives using numbers or emails you independently source (not those provided in recent emails or texts).

-

Be especially cautious if you receive an email or call about a last-minute change to wiring details—this is a common sign of a compromised account.

5. Recognize the Red Flags of Fraudulent Communication

-

Unexpected notifications of “urgent account issues.”

-

Messages with minor errors in sender addresses or URLs.

-

Email, text, or calls that ask for personal or financial information.

-

Requests for wire transfers to unfamiliar accounts, especially overseas.

6. Secure Your Accounts With Strong Practices

-

Enable two-factor (not SMS-only) authentication for online banking.

-

Use unique, complex passwords and change them regularly.

-

Set banking alerts for all large transactions and account changes.

7. Communicate With Your Bank Proactively

If you suspect any unusual activity, even if you’re unsure, contact your bank immediately. Early action increases the chances of halting fraud and may help recover funds.

Final Thoughts

Wire-transfer fraud thrives on distraction, urgency, and misplaced trust. The best defense is skepticism—always verify before you wire. Staying calm, informed, and ready to push back on suspicious requests will keep your bank account secure in a world where fraudsters are always trying new tricks.