Wire transfers are preferred for their speed, reliability, and seamless way to move funds across towns, countries, and continents in minutes.

But what if you suddenly realize a costly error, a typo in the recipient’s account number, a wire-transfer scam, or second thoughts moments after hitting “send”? The pressing question for anyone in this scenario is: Can a wire transfer be reversed?

The Harsh Reality: Most Wire Transfers Are Final

The honest answer is: once a wire transfer is complete and accepted by the recipient’s bank, it is almost always irreversible. The vast majority of wire transfers, especially domestic wires, cannot be canceled, disputed, or unilaterally recalled by the sender. This distinguishes wire transfers from credit card or debit card payments, which often come with consumer protections and chargeback options.

LifeLock Stolen Funds Reimbursement: Lifelock will cover you for personal expenses incurred as a result of identity theft, including reimbursement for stolen funds, up to $1 Million Coverage, depending on your plan.

Why Are Wire Transfers So Hard to Reverse?

-

Instant and Final: The beauty (and curse) of a wire is its immediacy. Funds land directly in the recipient’s account, and there’s no “pending” period.

-

Transfer Ownership: As soon as the recipient’s bank credits the funds, the money belongs to the recipient, out of the sender’s (and often the bank’s) control.

-

Legal Structure: Regulatory frameworks, like the Uniform Commercial Code, treat wires as “final settlements.” Unless an error or fraud can be proven, banks are not required to unwind completed transactions.

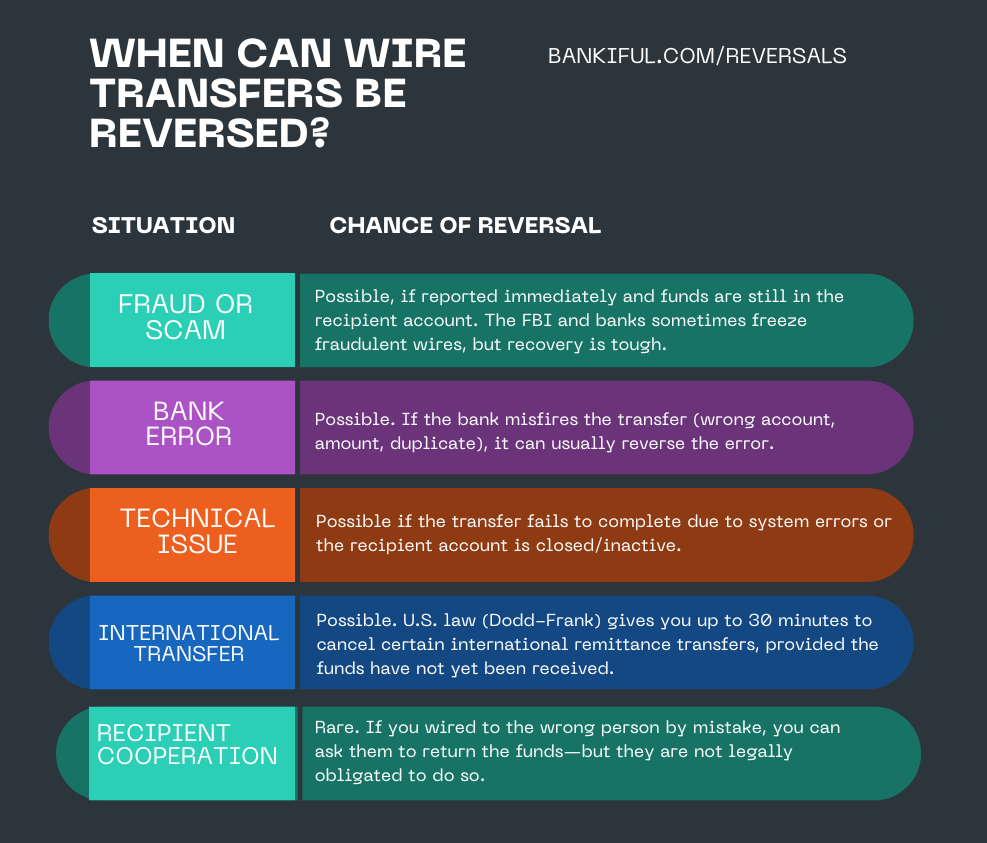

Are There Any Reversal Exceptions or Loopholes?

While reversal is unlikely, here are a few rare scenarios when a wire might be undone:

» MORE: Do Banks Refund Scammed Money

What Should You Do If You Need to Reverse a Wire Transfer?

-

Act Immediately: The moment you suspect an issue, contact your bank and the recipient bank at once with all transaction details. If the funds haven’t cleared, there’s a slim chance to halt the transfer.

-

Report Fraud: For suspected scams, involve your bank and law enforcement right away. Quick action is vital; some funds are only recoverable within hours and banks are not required to reimburse customers for wire-transfer fraud.

-

Check the Time Window: For international wires, see if you’re within the 30-minute “cooling off” period. If so, you might be able to reverse—ask your bank or provider for their specific policy.

-

Gather Evidence: Whether it’s a typo or fraud, presenting all transaction records, emails, and reference numbers can help banks investigate more swiftly.

Tips to Avoid Wire Transfer Regrets

-

Double-Check Everything: Before hitting “send,” review all recipient information carefully—account numbers, names, bank identifiers, and amounts.

-

Be Wary of Unfamiliar Requests: Never wire funds based on unsolicited calls or emails, especially those creating urgency or secrecy.

-

Understand Your Payment Method: Use credit cards or other payment methods with built-in fraud protection for transactions you might need to contest.

-

Know the Policy: If you wire internationally, ask your provider about cancellation windows before confirming.

Bottom Line

Wire transfers are designed to be final, fast, and irreversible. Reversals do happen—but only in rare, time-sensitive, or error-driven situations. For most senders, once the funds have cleared, the only realistic hope of getting money back is through the recipient’s voluntary cooperation or by proving outright fraud and moving extremely quickly.

So, can a wire transfer be reversed? For the vast majority of cases, the answer is straightforward: No. Once complete, it’s final. Your best defense is to exercise extreme care and vigilance before ever authorizing a wire.