Secured vs Unsecured Credit Cards: Which Builds Credit Faster?

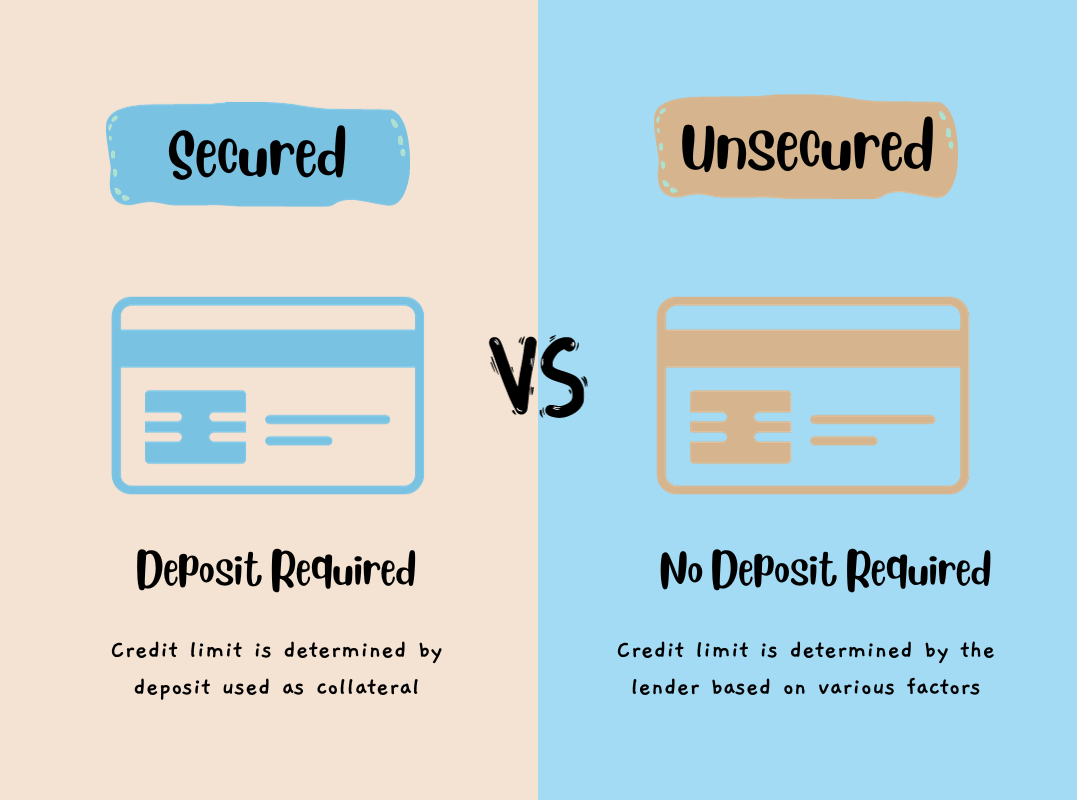

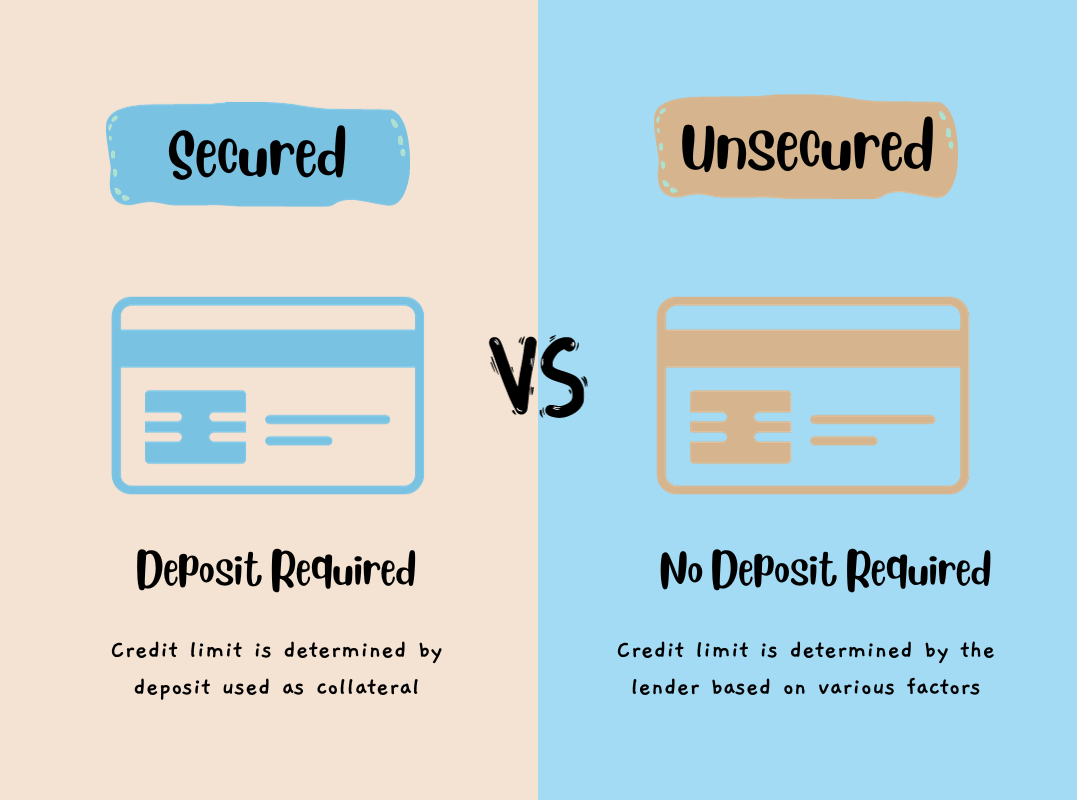

The main difference in secured vs. unsecured credit cards is the secured card requires a deposit, while the unsecured card does not.

The main difference in secured vs. unsecured credit cards is the secured card requires a deposit, while the unsecured card does not.

Guide to lenders that offer the best car loan for bad credit whether new, used or refinanced.

The numerous types of bank accounts can be confusing. That’s why we’ve narrowed the types of bank accounts down to the basics.

The premium is the amount of money you pay to the insurance company for coverage.

Grow your money faster and with less risk and higher rates with the strategy of Certificate of Deposit (CD) Ladders.

Banks, credit unions, and fintechs are financial institutions that offer various services, but they differ in structure and innovations.

Earn high interest with a savings account and conduct daily transactions with a checking account.

Dispute credit history based on one or more factual errors or inaccuracies.

Depending on your bank or credit union a money market minimum balance to open can be as little as $100 up $1,000 or more.

Discover which bank account – checking or savings – offers better protection for your hard-earned money. Learn how to safeguard your finances.

contact@bankiful.com

© 2025 Bankiful.com All rights reserved.

This website uses cookies to ensure you get the best experience on our website.